The Great Depression was a

world economic calamity that began in 1929 and it lasted until about 1939. It

was the longest and most severe depression ever experienced by the

industrialized Western world.

As we know that U.S

economy was the first one gone into the depression; the Great Depression may be

said to have begun with a unexpected collapse of stock- market prices on the

New York Stock Exchange in October 1929. Besides ruining a huge amount of individual

investors, this precipitous decline in the value of assets constrained banks

and other financial institutions. Many banks were consequently facing the

situation of insolvency. At this point the collapse in the stock market had

affect the aggregate supply in general. For these holding stocks in their

portfolios had loose great assets, so they would need to cut off the supply to

make up the loss, since they don't have any more money, they can just announce

bankruptcy. So those money people saved in the bank are gone; that was the

start of this severe economic war.

Since the

Great Depression started to disseminate, Willis C. Hawley(May 5,1864- July

24,1941) who was an American politician and educator in the state of Oregon

raised the Smoot-Hawley Tariff in 1930. The Smoot-Hawley of 1930 was the

subject of enormous controversy at the time of it passage and remains one of

the most notorious pieces of legislation in the history of the United State. The

usual assumption is the Smoot-Hawley tariff was the policy disaster that significantly

worsened the Great Depression. The original intention behind the legislation

was to increase the protection afforded domestic farmers against foreign

agricultural import. Due to the massive expansion in the agricultural

production sector outside of Europe during WW1 led to declining farm prices during

the second half of the decade. However, soon after this revision has been made,

it seems impossible to stop; a bill meant to provide relief for farmer became a

means to raise tariffs in all sectors of the economy. The Smoot-Hawley Tariff did not make the Great

Depression any better, but even worsen it. It provoked a storm of Foreign

retaliatory measures and came to stand as a symbol of the beggar- thy-neighbor”

( policies designed to improve one’s own lot at the expense of that of others) in

1930s. Such policies contributed to a drastic decline in international trade. For

example, U.S. imports from Europe declined from a 1929 high of $1,334 million

to just $390 million in 1932, while U.S exports to Europe fell from $2,341

million in 1929 to $784 million in 1932. Overall, world trade declined by some

66% between 1929 and 1934. So this legislation putted burden on import’s taxations

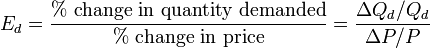

in order to protect the GDP stable. To set the price level higher from imports,

in order to decrease the demand of imports; which will cut the supply of production.

We all know that Great depression has already made a falling consumption and

falling investment spending that resulted in the equilibrium level of GDP being

far below its full employment level. It may seem like a brilliant idea to keep

the equilibrium level of stable by reducing the level of imports (EX-IM). However,

there was a potential flaw that Smoot-Hawley did not count in the negative

impact on U.S exports. In fact, it may have had a negative impact on exports if

foreign governments were led to retaliate against the passage of Smoot-Hawley

by raising tariffs on imports of U.S. goods. Generally, Smoot-Hawley did not

think comprehensively to consider the situation as a whole. Among all

information, the passage of Smoot-Hawley had been a policy blunder that had worsened the Great Depression

internationally at that time period.

After the Smoot-Hawley Tariff been

out and made economic worse; the election of Franklin Roosevelt had change the

role after all. As a representative of government, he worked to create numerous

programs in order to provide jobs for individuals through his New Deal, which

alleviated people who suffered from a harsh condition in Depression. His 10 New Deal programs were CCC(Civilian

conversation corps), CWA( Civil works administration), FHA(Federal housing

administration), FSA(Federal security agency), HOLC(Home owner’s loan

corporation) ,NRA(National recovery act), PWA(Public works administration),

SSA(Social security act), TVA(Tennessee valley authority), and WPA(Works

progress administration). The aim of these programs was creating jobs for

people, in order to active economic, so people can consume products, and

business can keep on.

However,

few of these programs failed to create sustainable jobs, even though it has

NOT DONE YET

Sources cite: 1.http://future.state.gov/when/timeline/1921_timeline/smoot_tariff.html tariff

4http://blog.aynrandcenter.org/the-new-deal-and-world-war-ii-didn%E2%80%99t-end-the-great-depression/ how did keynesian theory helped world out of econ recession.

5http://www.english.illinois.edu/maps/depression/about.htm about great depression

( from wikipedia)

( from wikipedia)